-

Commercialization Education -

FFMI fastPACE -

Frankel Cardiovascular Center Innovation Program -

Rogel Cancer Center Innovation Program -

Global Health Commercialization Competition -

Biomedical Innovation 101 -

Certificate in Biomedical Innovation & Entrepreneurship -

Fast Forward Medical Innovation Fellowship Program -

Biotech Career Development Program -

Drug Discovery & Development Course -

Innovation Studio -

Oncology Drug Discovery & Development (3D) Workshop -

FFMI fastPACE Train-the-Trainer -

Intellectual Property in the Academic Setting -

Drug Discovery and Development Course -

Medical Device Regulation -

Idea to Impact Webinar Series -

6 Tips for Customer Discovery -

Interacting with Industry -

Ask the Experts: A Biomedical Innovation Forum

-

-

Business Development -

Michigan Biomedical Venture Fund

Fast Forward Medical Innovation

We create a critical pipeline between research and the biomedical innovation life cycle.

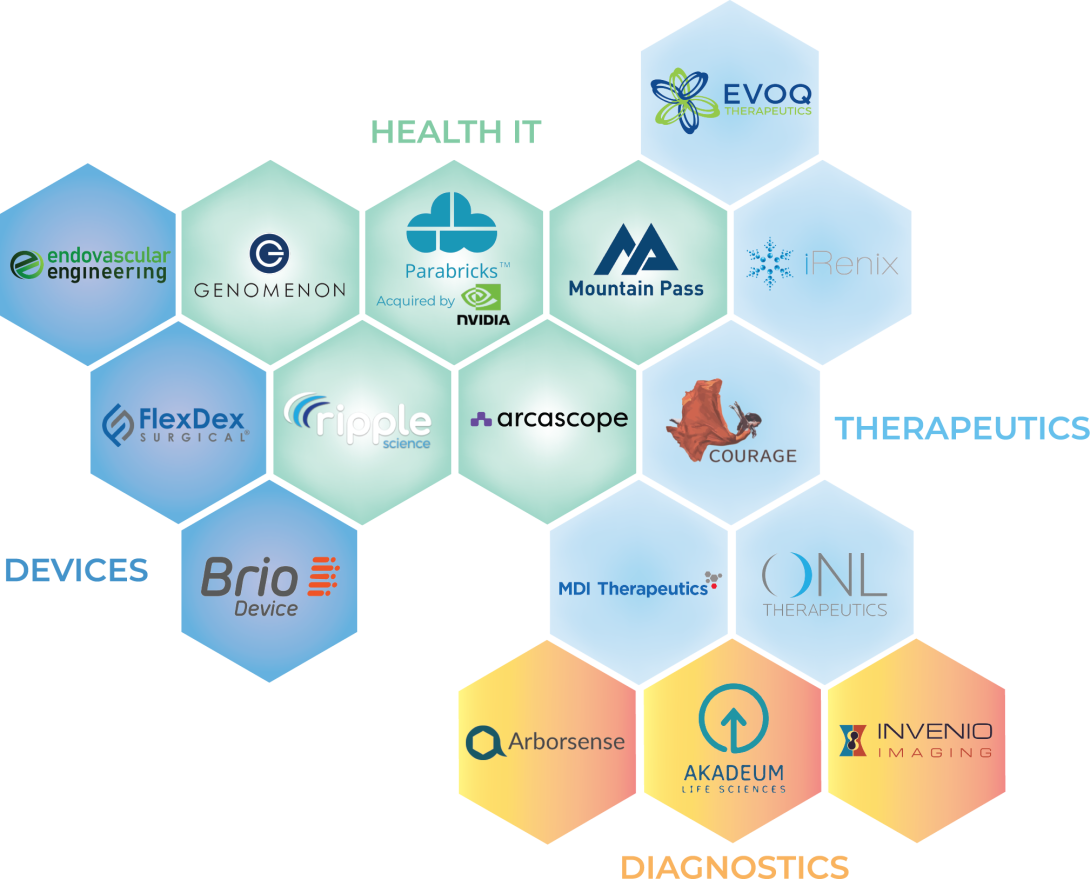

The Michigan Biomedical Venture Fund (MBVF) invests in and supports life science startup companies with U-M licensed intellectual property – including therapeutics, medical devices, diagnostics, and health IT. The MBVF is a collaborative effort between the U-M Medical School’s Fast Forward Medical Innovation (FFMI) program and the U-M College of Engineering’s Center for Entrepreneurship (CFE).

Founded based on an initial gift from the Monroe-Brown Foundation, MBVF makes seed-stage equity investments in UM life science startup companies, typically $100,000-$300,000. This evergreen fund serves to drive the university’s world-class leadership by creating a critical pipeline between research and the biomedical innovation life cycle, resulting in broad clinical and economic impact through startups.

The Fund is exclusively for biomedical startups with U-M IP. Most applicants need to successfully complete an existing U-M translational program such as Coulter, MTRAC for Life Sciences, NSF I-Corps. Companies interested in more information should consult with the Fund Manager.

Akadeum Life Sciences

Ann Arbor, MI

Brandon McNaughton, CEO

Akadeum Life Sciences developed a microbubble-based platform for live cell isolation with applications including cell and gene therapy manufacturing.

Arborsense

Ann Arbor, MI

Girish Kulkarni, President & Co-Founder

Arborsense makes wearable devices for continuous monitoring of blood alcohol content and other analytes directly from the skin.

Arcascope

Ann Arbor, MI

Olivia Walch, CEO

Arcascope developed a platform for sleep and alertness optimization based on circadian rhythm model, for shift workers and chronotherapy applications.

BRIO LLC

Ann Arbor, MI

Hannah Hensel, Co-Founder & CEO

Brio’s insertion stylets minimize reliance on clinician skill for success and are designed to assist users in locating the trachea and maneuvering the endotracheal tube through the mouth, throat, and airway.

Courage Therapeutics

Newton, MA

Dan Houseman, CEO

Courage Therapeutics is developing new medicines for eating disorders.

Endovascular Engineering

Menlo Park, CA

Mike Rosenthal, CEO

Endovascular Engineering developed a thrombectomy device to treat pulmonary embolism and deep vein thrombosis.

EVOQ Therapeutics

Ann Arbor, MI

William Brinkerhoff, Co-Founder & CEO

EVOQ offers nano-vaccine technology that is able to evoke potent anti-tumor T-cell responses that can eradicate tumors and establish long-term immunity against tumor recurrence.

FlexDex Surgical

Brighton, MI

James Geiger, CEO

FlexDex Surgical is an innovative medical device company bringing the benefits of minimally invasive surgery to more patients around the world by providing surgeons with tools that have the functionality of robots at the cost of traditional hand-held instruments.

GENOMENON

Ann Arbor, MI

Mike Klein, CEO

Genomenon’s software simplifies genome interpretation to improve diagnostic accuracy in clinical practice and speed genetic discoveries in research laboratories.

INVENIO

Santa Clara, CA

Jay Trautmann, President & CEO

Invenio’s NIO imaging system enables intraoperative histology, reducing downtime in the OR and allowing examination of specimens from multiple sites in the surgical cavity.

iRenix Medical

Palo Alto, CA

Stephen Smith, CEO

iRenix offers a novel antiseptic for intravitreal injections/ophthalmic procedures.

MDI Therapeutics

Ann Arbor, MI

Stephen Benoit, President & CEO

Leveraging the world-renowned research of founder Dan Lawrence in serpin biology. MDI Therapeutics has discovered a new class of small molecule inhibitors of plasminogen activator inhibitor-type 1 (PAI-1) for the treatment of fibrosis.

Mountain Pass

Ann Arbor, MI

Tom Simon, CEO

Mountain Pass Solutions (MPS) offers a fully configurable workflow management system as a SaaS product.

ONL Therapeutics

Ann Arbor, MI

John Freshley, President & CEO

ONL offers a first-in-class therapy to protect the vision of patients with retinal disease, using a Fas inhibitor designed to protect against retinal cell death.

Parabricks

Exited – acquired by Nvidia

Ann Arbor, MI

Mehrzad Samedi, CEO and Co-founder

Parabricks helps companies and researchers sequence whole human genomes 48x faster than conventional next-generation sequencing pipelines saving on computation costs with faster throughputs.

Ripple Science

Ann Arbor, MI

Peter Falzon, Co-Founder & CEO

Ripple Science offers program management software for recruiting subjects for academic or industry studies.

The Investment Advisory Board (IAB) is comprised of 7-10 members and advises on all investment decisions. IAB members include individuals with domain expertise, successful venture capitalists, entrepreneurs, and other investors in healthcare and biotech. Members do not have an official U-M appointment or specific ties to existing U-M funding programs (one representative is appointed to the IAB by the U-M Investment Office). The IAB is operationally independent from the Deal Flow Council. IAB Board Members are:

- Amit Aysola, MSE, MBA – Managing Partner, Create Health Ventures

- Sundaresh Brahmasandra, PhD, Biotech Entrepreneur, VP Strata Oncology

- Rafael Castilla, JD, Director MINTS, U-M Investment Office

- Dan Estes, PhD, General Partner, Frazier Life Sciences

- Brian Gallagher, MS, PhD, Biotech Investor & Entrepreneur

- Rekha Hemrajani, MS, Life Science CEO & Board Member

- Dan Kidle, BBA, MBA, Partner, Arboretum Ventures

- Jason Lettman, MBA, Partner, Lightstone Ventures

- Julia Owens, PhD, Biotech CEO, Advisor & Board Member

- Ellen Sheets, MD, MBA.., Healthcare Exec, CEO SeQure Dx

- C.R. Sincock, Investor & Entrepreneur, AvFuel, Transhuman Capital

Any U-M startup that has a U-M license/option and has a biomedical or healthcare focus is eligible to receive funding. Since this is an early-stage venture fund we fund at the angel or seed level, and in some case at the Series A stage. We do not make our first investment in rounds later than the Series A stage.

Yes, you can still apply while the licensing is still in progress. The final funding is contingent on obtaining the license/option.

Yes, you can still apply while the company formation is in progress. The final funding is contingent on company formation, and proof of business entity registration is required.

Applications are accepted on a rolling basis. It is highly recommended that you contact the program manager before applying. Once we receive a company’s application, we’ll begin the initial due-diligence process (about 4-6 weeks). Select teams will be recommended to present to the external Investment Advisory Board (IAB). During this time, companies have to address issues raised by the Board and the Program Manager as they perform further due diligence (4-8 weeks). In most cases, companies are funded after addressing feedback from the introductory meeting with the Board. Typically, the entire process takes 2 to 4 months.

Sorry, at this moment we are not considering student-IP owned startups from U-M.

Since most companies are very early-stage, we want to keep the terms as simple and easy as possible. We are open to using a Simple Agreement for Future Equity (SAFE) agreement or a convertible note. In cases where syndicates are being formed, we are happy to follow the lead investor’s term sheet subject to certain provisions.

"FFMI's fastPACE commercialization course helped us learn a lot of the basics and develop our first business model canvas. Several years later, the Michigan Biomedical Venture Fund provided investment and valuable connections, including introductions to potential collaborators. We are now exploring optimizing the timing of immunotherapy and other conditions with U-M researchers."

Building 520, 3rd Floor

2800 Plymouth Road

Ann Arbor, MI 48109-2800